FACT CHECK: Are New Stimulus Checks Coming? What We Know About IRS Stimulus Checks Eligibility

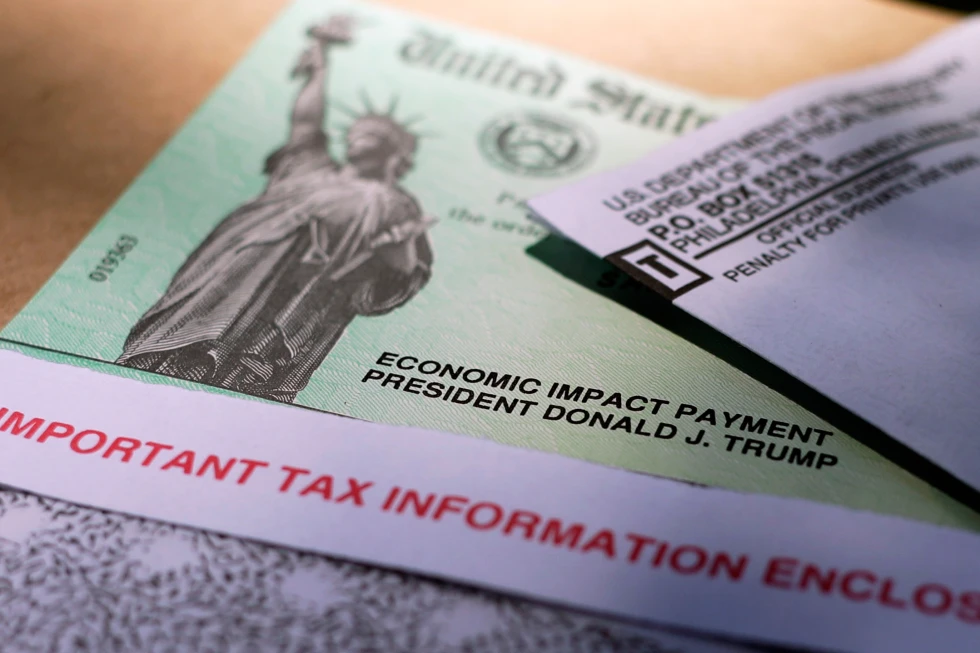

Online rumors are spreading that a new round of stimulus checks is on the way, with claims of payments up to $1,390 being distributed this summer. However, it’s important to understand the facts. As of now, no new stimulus program has been approved by the U.S. Congress, and the IRS has confirmed that no new checks will be issued.

To help clarify the situation, let’s look at how past payments have been handled and what we know about IRS stimulus checks eligibility.

The Truth: No New Stimulus Checks Are Approved

The notion that a new stimulus check is set to arrive is false. Any such payment would require new legislation from Congress to be funded and authorized. The IRS, which distributes these payments, would then publicly announce the program on its official website. Neither of these steps has been taken.

The confusion may stem from payments issued earlier this year, which were not a new stimulus. The IRS distributed about $2.4 billion in Recovery Rebate Credits to taxpayers who had not claimed a previous stimulus payment from the 2021 tax year. These were essentially “plus-up” or correction payments for past stimulus rounds, not a new program. To have been eligible for these, taxpayers had to have filed their 2021 tax return by the April 15 deadline.

Understanding Past IRS Stimulus Checks Eligibility

The eligibility criteria for past stimulus payments have been based on a few key factors: income, tax-filing status, and dependent status. While the amounts and specific rules have varied by bill, the general framework remains consistent.

For the three rounds of COVID-19 Economic Impact Payments, a person was eligible if they met the following criteria:

- Income Thresholds:

- Individuals with an adjusted gross income (AGI) of up to $75,000.

- Heads of household with an AGI of up to $112,500.

- Married couples filing jointly with an AGI of up to $150,000.

- Payments were reduced for those with incomes above these thresholds.

- Social Security Number: To be eligible, an individual and their qualifying children had to have a Social Security number.

- Filing a Tax Return: Payments were typically based on the most recently filed tax return (2019 or 2020) to determine eligibility.

Similarly, the 2008 stimulus checks had their own income-based eligibility rules. The key takeaway is that eligibility is always determined by a specific law passed by Congress.

The Proposed American Worker Rebate Act

Some of the recent speculation may be confusing past payments with a real, but unapproved, bill in Washington. Senator Josh Hawley’s “American Worker Rebate Act of 2025” proposes tax rebates funded by tariffs.

While this is a real piece of legislation, it is not a stimulus check and has its own set of proposed eligibility rules. The bill, which has not yet passed, would provide a minimum of $600 per individual and their dependents, but with reduced amounts for individuals with an annual gross income above $75,000. This demonstrates how a new payment’s eligibility is always tied to specific legislative details.

To be sure about your eligibility for any future payment, always refer to the official IRS.gov website for direct, accurate information.